Ten years ago, in the aftermath of the financial crisis the banking community and regulatory authorities embraced the use of enhanced modeling and stress-testing to ward against a future event having such an significant impact on the Nation’s banking environment.

Those efforts aided by strong economic recovery, have resulted in increased capital levels and stronger balance sheets across the universe of both the large mega-banks and smaller community banks. CEIS Review embraces these efforts and supports their usefulness as management tools.

THE LIMITATIONS OF MODELING

The short-coming of modeling – no matter how sophisticated the correlation-tested variables employed by the modelers – is that they are still subject to extreme exogenous events that no one foresees, e.g., the “dot-com” bubble, the “Lehman event” of the last financial crisis, or currently, the emergence of the coronavirus.

Model drivers, of course, can be re-calibrated after the fact and new forecasts generated, but at the community bank level particularly, wouldn’t it be more valuable to assess which of your specific borrowers are most likely to be impacted by these macro events, become potential drains on your reserves & capital and hence, likely to need possible adjustments to loan terms to stave off anticipated financial difficulties?

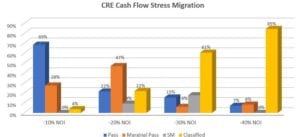

Commercial Real Estate Cash Flow Stress Migration

THE CEIS REVIEW APPROACH

CEIS’ experience has shown that the sourcing of high-quality data is, and remains, a key challenge of many institutions. Even a comprehensive and well-designed stress testing model will fail to produce reliable results if the data inputs are inconsistent.

CEIS Review has performed over 250 stress tests for commercial banks across the U.S. over the course of a decade. While we offer both (a) Top-Down “CCAR” and (b) Bottom-Up “loan level” approaches to stress testing, we are uniquely positioned to evaluate the impact of stresses at the loan level because CEIS is an industry leader in conducting Borrower loan reviews at a “boots-on-the-ground” level, particularly at the community banks.

If you are interested in getting a bottom-up view of how your portfolio might react to stress conditions, we can assist you. For banks who are not existing clients, we can accept data downloads and work with you to transfer your data into our model framework.

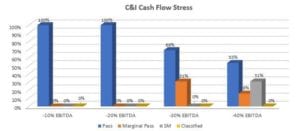

Commercial & Industrial Cash Flow Stress Migration

Our experienced staff will work directly with the bank during every phase of the process to ensure not only the accuracy of the outcomes, but to ensure that bank management understands the process and can convey this as their own.

Contact CEIS Review to start Stress Testing your Institution’s Portfolio