Click To View As PDF: The CEIS Review Quarterly V7, i1

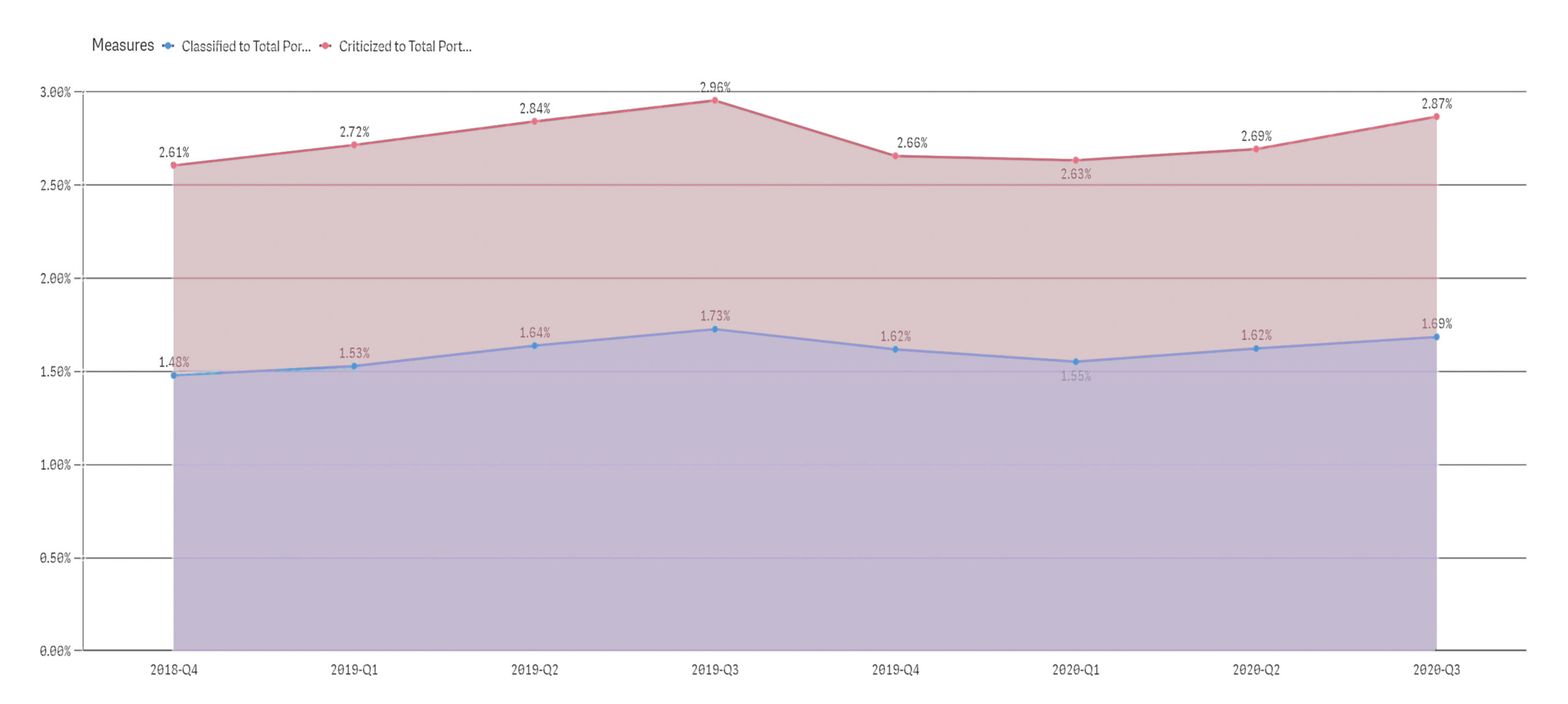

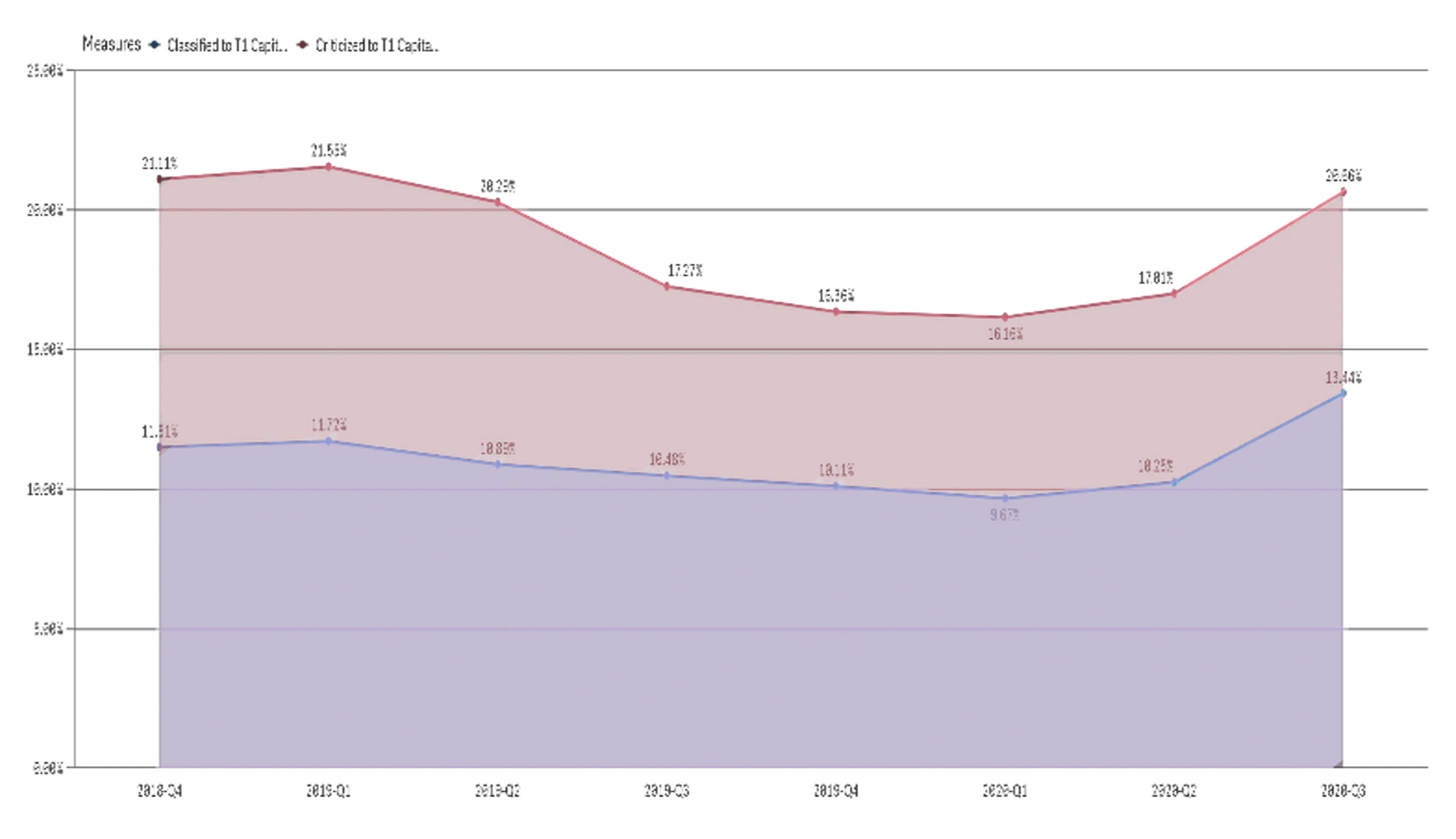

CEIS Review has recently begun to observe stress’s being applied to commercial portfolios reflected within our aggregated portfolio findings. CEIS’ internal Loan Portfolio Quality Statistics (“LPQS”) are beginning to show a modest – to moderate increase, in the criticized and classified loan level ratios relative to total portfolio outstanding’s as outlined below. This gradual rise alone is not too meaningful, but coupled with the knowledge of increasing borrower delinquencies, additional loan modifications taking place, and additional community lockdowns being enforced may present a different picture.

While initially modest, the developing trend line above indicates that the increases have occurred during the most recent three quarters, and the quarterly rises have become more pronounced as additional quarters elapse. This observation as well as CEIS’ industry knowledge has led to the internal consensus that this trend line will become more aggressive over the next six to twelve months as assets are re-classified.

At this time of this writing, loan quality ratios are generally within the parameters of what meets the definition of a “satisfactory” portfolio. Portfolios managers should start to receive more current financial information from borrowers, that coupled with 2020 YTD data may prompt risk rating changes and potentially TDR status consideration the updated guidance.

A further thought regarding the TDR topic is that – CEIS has observed that negative grade migration has been slowed as a result of Bank’s maintaining Pass grades for borrowers who have received COVID-19 modifications, and when these modifications expire (typically 6 months), and borrowers are then unable to service their debt, this could potentially lead to a surge in downgrades forced by the 90-day post modification delinquency period (90 day delinquency at some time following the COVID-19 modification requiring accrual status), and this non-accrual time line is approaching. A major caveat to this statement is the unknown effects of additional Federal Relief which has just been approved.

A further thought regarding the TDR topic is that – CEIS has observed that negative grade migration has been slowed as a result of Bank’s maintaining Pass grades for borrowers who have received COVID-19 modifications, and when these modifications expire (typically 6 months), and borrowers are then unable to service their debt, this could potentially lead to a surge in downgrades forced by the 90-day post modification delinquency period (90 day delinquency at some time following the COVID-19 modification requiring accrual status), and this non-accrual time line is approaching. A major caveat to this statement is the unknown effects of additional Federal Relief which has just been approved.

CEIS has observed and increase in borrowers with Reporting Requirement Exceptions/Delays YoY (27% – 35%), which has led to an increase in covenant non-compliance as many institutions only calculate borrowers covenant compliance 1x annually during the annual review. By only performing a full borrower analysis annually institutions may be forgoing an opportunity to better reserve their rights within the loan agreement.

New and Renewed Loans are showing an increase in Credit Policy Exceptions over the prior two quarters, and while many of the exceptions have been offset by mitigating factors, Institutions may want to review their policies considering the current environment as eventually those mitigating factors will either not be present for the borrower/ facility (i.e. government relief), or they will no longer be acceptable or valued as mitigating factors.

Troubled loans are clustered in the retail and hospitality sectors, with multifamily following closely behind. Commercial real estate’s darling, multifamily, has recently been reporting a 25%+ increase in rental delinquencies. Such an increase questions the reliability of Debt Service Coverage Ratio’s that are based on 2019 NOI’s and/or rent rolls.

Parting thoughts – CEIS advises Institutions to reach out their borrowers to receive updated financials (YTD) and to reassess each borrowers risk rating upon receipt and analysis of those updated financials, and to continue this effort on a heightened frequency during these times so that any unforeseen issue is more readily identified.

MORE NOTABLE BANK EXAMINER CONCERNS

- Given the economic impact of the coronavirus still masked by numerous relief efforts in 2020 and proposed for 2021, community banks should act conservatively in 2021. Ensuring they have proper risk management processes in place. Understand the risk in your portfolio.

- A greater focus on industry and group concentrations in loan portfolios. It is recommended that Banks review current concentration limits, adjust as appropriate and closely monitor, especially in higher risk industries such as real estate, retail, hospitality and leisure and travel.

- More emphasis placed around timely and ongoing loan reviews with expectations that Banks increase the frequency of individual loan reviews based on severity of risk. Quarterly or monthly reviews for higher risk transactions may be appropriate.

- Closer tracking of adherence to credit policy. Banks are cautioned to keep policy exceptions to a minimum and properly document all mitigating factors in detail. Banks are recommended to take a thorough look at their policies including determination of appropriate underwriting risk parameters and metrics.

- Risk Ratings – It is important to understand the key risks of each individual borrower, considering financial performance pre-COVID-19, the impact of COVID-19 both short term and long term, relief/stimulus provided during the pandemic, repayment ability, collateral, and industry considerations. Banks should be in close contact with their largest borrowers and those with higher risk loans.

- Banks need to exercise good judgement with borrowers going forward as they come off the loan deferrals or may need additional time. Regulators will continue to look at all aspects of risk and relevant information on borrowers including the willingness and ability of sponsors to support the underlying borrowers, with focus on sufficient liquidity or alternative cash flow to cover shortfalls.

- Stress testing is suggested on both a loan and portfolio basis. Additionally, Banks are recommended to perform a pandemic stress test analysis that segregates the loan portfolio by NAICS code so Banks can see which industries are potential problem segments.

- Expected increase in M&A activity in 2021 as stronger banks take advantage of opportunities with weaker performing institutions as well as the potential for more IT and Fintech related partnerships.

- While the CECL deadline for Community Banks is not for a few years, Banks are recommended to prepare sooner rather than later.

- It is recommended that Banks speak with their regulators before issuing dividends or buying back stock.

HAVE YOU PLANNED FOR THE REPLACEMENT OF LIBOR? WILL YOU USE SOFR?

There are many methods for pricing credits. But regardless of whether this pricing takes the form of a fixed or adjustable rate, the goal of the financial institution is to ensure the loan remains above the funding cost and incorporates the risk of the credit over the expected term of the credit. Borrowers prefer to have transparency in their loan pricing. No one wants to borrow money with the uncertainty that the bank can raise the rate to whatever they feel like. To address transparency, financial institutions use benchmark rates, adjusting from that benchmark according to the term and credit quality associated with the loan. This methodology allows the institution to arrive at a price that is appropriate for the borrower, the financial institution and provides an overall competitive rate.

The Prime rate was one of the first benchmarks. The U.S. has long determined a bank prime rate. In 1947, the Wall Street Journal (WSJ) conducted a survey of major banks, using that information to publish a prime rate index. Today, WSJ defines the WSJ Prime Rate as, “the base rate on corporate loans posted by at least 70% of the 10 largest U.S. banks.” Historically, the WSJ Prime Rate runs approximately 300 basis points (bps) above the federal funds rate.

In 1986, a new benchmark became available for use in setting interest rates: the London Interbank Offer Rate (LIBOR). This benchmark brought with it more frequent resets than the Prime Rate and the belief that it better reflected a bank’s cost of funds (as LIBOR is based on the rate banks loan to each other). Like many indices, it was based on an average of information provided by the banks to a central authority.

The first cracks in using LIBOR as a benchmark rate appeared during the 2008 financial crisis, when uncertainty relating to the survival of some of the largest banks resulted in a LIBOR that increased rapidly. Despite central banks cutting interest rates, the rate-setting banks estimated higher and higher interest rates, making loans more expensive and helping LIBOR play a part in spreading the financial crisis. Unfortunately, the reporting relies on a certain level of trust that the rate-setting banks were not manipulating the rate in order to gain an advantage. This fact brought with it the proverbial straw that broke the camel’s back came in 2012, when it was discovered that bankers were manipulating LIBOR for self-gain. You see, when you are dealing in very large amounts of money and other instruments, very small reporting adjustments can result in substantial profits.

As a result, a search began for a replacement benchmark rate that better represented the current state of interest rates. In 2014, the Federal Reserve Board and the New York Federal Reserve Bank created a committee called the Alternative Reference Rates Committee (ARRC) to explore alternatives to LIBOR. In 2017, the committee identified the Secured Overnight Financing Rate (SOFR) as an alternative to USD LIBOR and announced that the USD LIBOR rates will cease to be presented as rates at the end of 2021. From there, the committee began work to identify a transition plan for the many financial instruments priced using LIBOR. While there are many, many such financial instruments, this article focuses on adjustable rate loans and mortgages that are used by many community banks to price their credits.

What is SOFR?

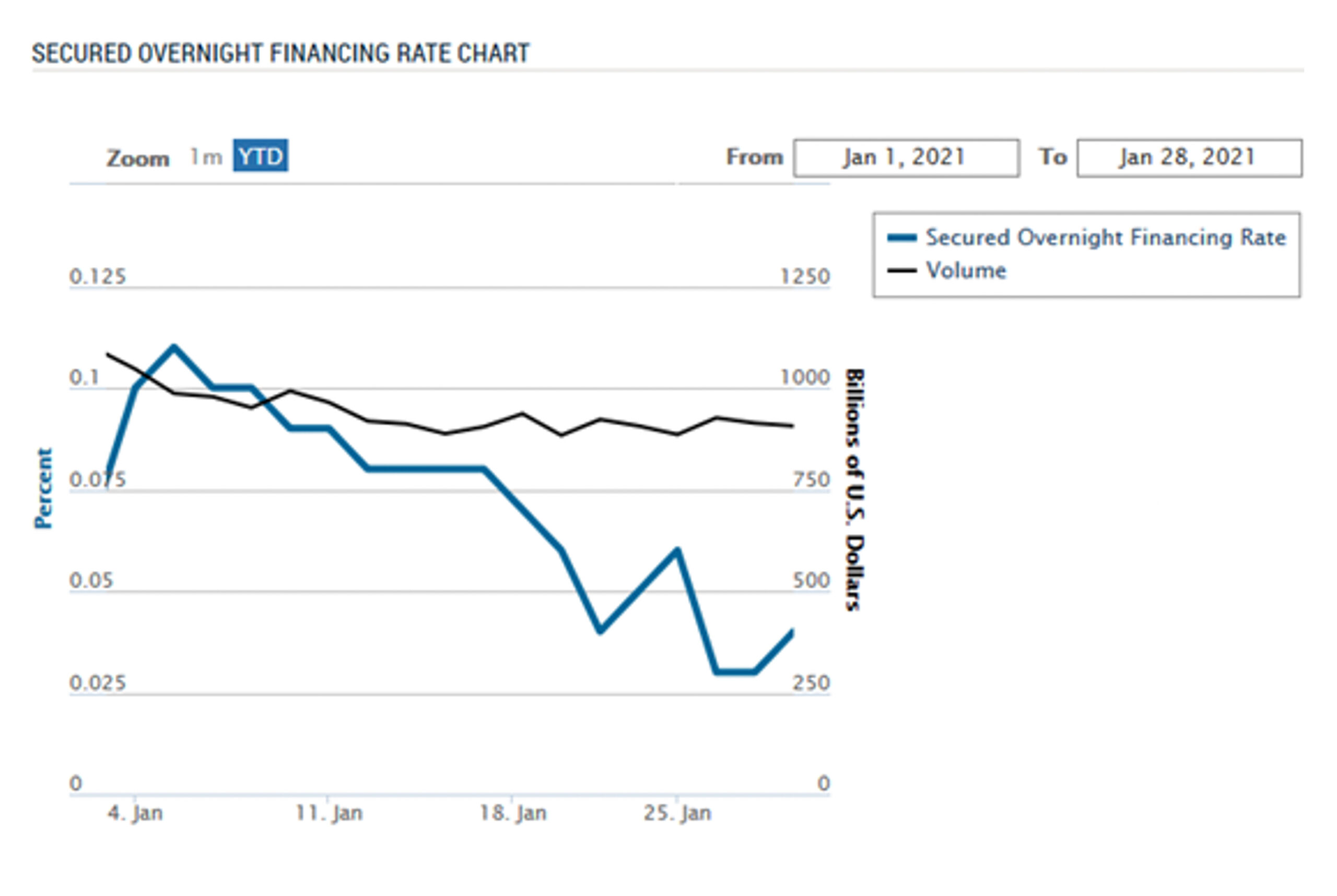

SOFR is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities in the repurchase agreement (REPO) market. It is produced by the New York Federal Reserve Bank each business day at approximately 8:00 AM Eastern Standard Time. The advantages to SOFR are threefold:

- It has a lot of activity (volume),

- It is transparent, and

- It is not at risk of disappearing (since it is based on the U.S. Treasury repo market).

The principal disadvantage is that the credit risk component is based on the risk of the U.S. government failing, which means it is essentially a risk-free rate. Although the premise of a risk-free rate seems positive, the lack of a credit-risk component means that it is slower to adjust to changing market conditions. Because LIBOR had a credit-risk component, it adjusted to changing market conditions far more readily, with the exception of the 2008 crisis.

Because SOFR is an overnight rate that relies on transactional data, as opposed to LIBOR’s seven varying term rates and market data, the transition isn’t as simple as replacing the acronym. There’s enough of a variation in the way the two rates are calculated that deciding how to incorporate the rate into your new contracts and how to adjust rates in your existing contracts will be a complicated process.2 Compounding on this difficulty is the note that a future-facing, regulatory-complaint SOFR term rate is unlikely to be available by the end of the year, due to the lack of a SOFR derivatives market with enough historical context. That being said, there is a plan in place to establish this forward-looking SOFR rate.

In September 2020, the ARRC published an RFP with the goal of establishing an administrative body who will be responsible for calculating and publishing the SOFR term rates on a daily basis. The RFP requests these term rates include a 1-month and 3-month maturity, with 6-month and 1-year also considered “feasible.” This data will be offered to other vendors and parties at reasonable cost. Though the ARRC gives no “guarantee that the SOFR term rate will ultimately be endorsed,” it does give an indication that a rate similar in term length as the USD LIBOR options will become available at some point. The ARRC even mentions that this forward rate may be published in the first half of 2021, provided that “liquidity in SOFR derivatives markets has developed sufficiently.”3

A Bank does not have to adopt SOFR. What benchmark or spread should a Bank use?

With all this in mind, many regulators and regulatory agencies are recommending including clauses in contracts that specifically lay out how differences in SOFR in LIBOR will be calculated, especially when considering possible variances in the discontinuation date. Late November 2020 brought with it an announcement from the ICE Benchmark Administration (IBA) that they were consulting on potential plans to push the discontinuation date for the 3-, 6-, and 12-month USD LIBOR rates into a late June 2023 retirement.4 The volatility in the situation should be enough encouragement to prompt you to prepare to fully handle SOFR by phasing out LIBOR sooner rather than later.

For new adjustable-rate mortgages in the U.S., the Alternative Reference Rates Committee (ARRC) has recommended using SOFR as the referenced rate index in the contract since September 2020.5 However, with adjustable-rate loans decreasing in use since the 2008 financial crisis, the more likely scenario is handling your existing adjustable rate mortgage(s). Financial institutions are already in the process of determining what benchmark to use and how to communicate this to customers. Mortgage holders are likely to have already heard (or will soon) from their loan servicer for information about how the flip to SOFR will affect your specific loan if it previously was based on LIBOR. As a financial institution, reviewing your existing adjustable-rate loans and mortgages utilizing the LIBOR rate should be a high priority, especially as we continue on through 2021.

For many community banks, mitigating this transitionary risk requires consideration of factors, including when to fully make the transition to SOFR, how to streamline your LIBOR-based contract amendments, and how to handle the benchmark spread adjustment. While the first two will vary based on your institution’s overall transition plan, the third may require some guidance. For now, the ARRC is in a similar place with that spread adjustment as they are with the forward rate: an RFP was issued in September 2020 for one or more firms to publish daily indicative spreads. When these firms are chosen, they’ll also provide static spreads and spread adjusted fallback rates if a trigger event has occurred. The specific contract language for hardwired fallbacks will be clearer after these firms are chosen.6

Other users of LIBOR, such as The International Swaps and Derivatives Association (ISDA), has already released their fallback rate (SOFR Compounded in Arrears) and their static spread adjustment for swaps that fall back from LIBOR (the five-year historical median difference between SOFR and LIBOR for each tenor pair).7 This indicative spread is already being published by Bloomberg, so there is some guidance to go on, even if the ARRC is still out on some of the specifics.8

Conclusion

On November 20, 2020, the U.S. regulators (FRB, FDIC and the OCC) issued a Statement on LIBOR Transition. The Statement address the transition to LIBOR and states the following, “Given consumer protection, litigation, and reputation risks, the agencies believe entering into new contracts that use USD LIBOR as a reference rate after December 31, 2021, would create safety and soundness risks and will examine bank practices accordingly. New contracts entered into before December 31, 2021 should either utilize a reference rate other than LIBOR or have robust fallback language that includes a clearly defined alternative reference rate after LIBOR’s discontinuation. These actions are necessary to facilitate an orderly – and safe and sound – LIBOR transition.”

With the transition timeline working to push LIBOR into the sunset in a short timeframe, adjusting your contracts and other LIBOR-referencing documentation sooner rather than later is a good start toward ensuring your institution is planning for SOFR’s benchmark rate takeover. To ensure you’re preparing for any risk associated with the transition (especially contractually), understanding the differences in measurement, paying close attention to the results of the ARRC’s RFPs, and being proactive and considerate in your replacement strategies are all keys to reducing any potential negative impact of this shift in benchmark.

CEIS is working with our clients to determine the impact of the retirement of LIBOR as well as determine a good way to create a spread over SOFR or select an alternative benchmark. This focus is on the credits on the balance sheet; commercial, mortgage and consumer. As the year progresses, CEIS will provide an update as to the direction others are taking as they address this important change. LIBOR is going away. The method by which a transition takes place has the potential to dramatically impact earnings for years to come.

1 New York Fed. 2021. “Secured Overnight Financing Rate Data.” Last modified January 29, 2021. https://apps.newyorkfed.org/markets/autorates/SOFR.

2 Morgan Stanley. 2019. “Transitioning LIBOR: What It Means for Investors.” Last modified October 29, 2019. https://www.morganstanley.com/ideas/libor-its-end-transition-to-sofr.

3 New York Fed. 2020. “ARRC Releases Request for Proposals for the Publication of Forward-Looking SOFR Term Rates.” Last modified September 10, 2020.

https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2020/ARRC_Press_Release_Term_Rate_RFP.pdf

4 Bloomberg. 2020. “Libor’s Final Retirement Date May Get Delayed Until Mid-2023.” Last modified November 30, 2020. https://www.bloomberg.com/news/articles/

2020-11-30/three-month-dollar-libor-may-win-retirement-reprieve-to-mid-2023

5 Bankrate. 2020. “New index for adjustable mortgages, home equity loans may change your payment.” Last modified Sept 14, 2020. https://www.bankrate.com/mortgages/

libor-to-sofr-index-change-is-underway-for-helocs-arms-reverse-mortgages/

6 New York Fed. 2020. “ARRC Releases Request for Proposals for the Administration of Recommended Spread Adjustments and Spread-Adjusted SOFR Rates to Facilitate

Contractual Fallbacks.” Last modified September 2, 2020. https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2020/20200902-ARRC-Press-Release-SpreadAdjustment-RFP-FINAL

7 LSTA. 2020. “To Dream the Possible Dream: Term SOFR & Spread Adjustments.” Last modified September 15, 2020. https://www.lsta.org/news-resources/to-dream-thepossible-dream-term-sofr-spread-adjustments/

8 Bloomberg Professional Services. 2020. “LIBOR Transition Regulation.” Last modified Jan 29, 2021. https://www.bloomberg.com/professional/solution/libor-transition/