“Bottom Up” Loan Level Approach

CEIS’s “Bottom-Up” stress testing programs are a tool for an Institution’s Board and Senior Management to utilize when planning for possible credit risk and loss exposures occurring under several varying economic scenarios.

CEIS’ dynamic multi-scenario stress analysis tests each borrower’s ability for repayment under mild, moderate, severe, and extreme economic situations. Portfolios and segments are analyzed under potential downside scenarios to assess the impact on criticized loan levels, loan loss reserves, and capital requirements.

Led and Managed by Senior Banking Executives

Validated by a third party CPA firm.

- Stand-Alone “Bottom Up” loan level Portfolio Stress Testing– CEIS either receives an accurate and complete set of information from the institution, or assigns CEIS staff to collect the information on the institutions behalf, and then performs the Portfolio Stress Testing analysis with agreed upon scenarios and parameters resulting in a draft and subsequent final report for the client while presenting the findings to management and/or the board.

- Loan Review (LR) and Stress Testing Engagement – CEIS performs the loan review for the institution, and throughout the LR program CEIS’ team captures the loan level financial data as well as other Bank reporting needed for the stress testing analysis. By dually engaging CEIS Review for loan review and stress testing you gain assurance that the data collection, data verification, and the stress testing programs are handled by experienced credit professionals by a firm with breadth and industry tenure.

Contact us to discuss a stress testing program for your Commercial Loan Portfolio

“

CEIS Review has been an important part of our Bank’s commercial lending review function ever since the Bank decided to outsource the annual portfolio review and Stress Testing. CEIS’ professionalism and market insights assists are welcomed strengths to our Credit Risk Management program.

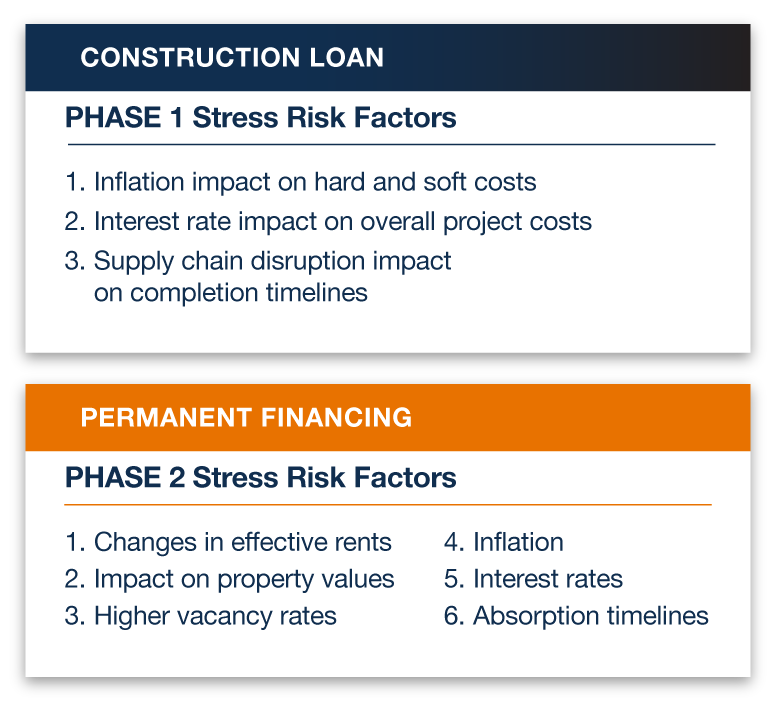

CRE Construction Stress Testing

The CRE construction loan portfolio is considered a more volatile and riskier segment of the overall commercial loan portfolio. For those reasons, in addition to regulatory scrutiny pertaining to construction portfolio growth and concentrations, CEIS has enhanced our CRE Construction Stress Testing approach.

Given the variables that go into financing a construction project pertaining to costs and timing, it is only prudent to further examine this portfolio segment for indications of weakness along the lifecycle of the provided financing, and potentially thereafter.

CEIS’ enhanced CRE Construction Stress Testing addresses each project individually during their a) Project Phase and b) the Completion Phase. By assessing each project by phase, it allows clients to further understand the potential impact that fluctuations in supplies labor interest rates refinance availability and timelines of each project’s effected budget.

Briefly:

- CEIS’ robust repeatable methodology can be applied to land development, commercial construction and residential/commercial condominium development transactions

- Transaction-based approach rolling up to the segment level

- Two-Phase View

- Project Phase: focus on finance risk for cost of completion: Budget vs Actual

- Completion Phase: Refinance risk takeout financing

- Two levels of stress to each transaction: 1) Moderate and 2) Severe.

- Customized stress based on CRE segments. locations, current, and future market conditions

Client Benefits:

- Forward looking to identify strengths and weaknesses

- Transaction- to segment-level analysis

- Detailed data per exposure included in the stress test

- Customizable to client-specific requests

- Detailed reporting enabling actionable insights for management and the BOD

- Customizable, multivariable approach

- Multiformat results: Project vs Completion; Moderate vs Severe stress

Contact us today to discuss your Portfolio Stress Testing project.