FDIC Implementing technical tools to Assist Financial Institutions – CEIS Quarterly Newsletter – Volume 6, Issue 4

To View in PDF: Select here: The CEIS Review Quarterly – Volume 6, Issue 4

After attending this year’s RMA “virtual” risk management conference there are a few takeaways we would like to share for the benefit of our clients. Of note was the FDIC’s session discussing their 2021 focus areas, and specifically loan review.

Ms. Doreen R. Eberley, Director Division of Risk Management Supervision, shared that the FDIC is currently and planning on continuing all their loan review exami- nations remotely. Doreen shared that the FDIC has implemented several technical tools to assist Institutions in complying with the remote request, and aside from the FDIC tools, Banks are free to use their own technology tools to enable FDIC remote examinations.

Just as the FDIC has migrated to 100% remote reviews, CEIS also has had this capa- bility for Institutions to utilize for remote assignments.

To learn more about CEIS Review and our capabilities, please contact us here.

SETTING UP YOUR ALLL/CECL MODEL FOR Q4 2020

Year end is fast approaching. And so far, the impact to the banking universe of the COVID recession has been largely blunted by the CARES Act, which enabled finan- cial institutions to provide deferments to customers without having to downgrade or move credits to the TDR category. Additionally, the PPP loans have provided many community banks with an additional source of income and customers. 2020 may turn out to be not a disaster for the industry. 2021 may…or may not…be the year when the deferred losses impact the bottom line and we find ourselves in the midst of a credit crisis.

In 1987, as the Cold War was winding down, a scenario analysis approach was developed using the concepts of Volatility, Uncertainty, Complexity and Ambiguity (VUCA) to identify the risks that were emerging from this change. etvolo.

In 1987, as the Cold War was winding down, a scenario analysis approach was developed using the concepts of Volatility, Uncertainty, Complexity and Ambiguity (VUCA) to identify the risks that were emerging from this change. The world had been living with the Cold War since the 1950’s and no one quite knew how it would end. It seems like we are in a very similar position right now given that the world has not suffered from this threat in over a century. Because of this, we do not have loss data that provides the banking industry with a reliable foundation on which to manage both the reserve and the capital position of the Bank.

Moody’s Analytics REIS just released the following Q3 2020 CRE market trends and summaries where they noted;

Apartment Sector – National asking and effective rents declined at a record pace in the third quarter, falling by 1.8% and 1.9%, respectively. This is the largest decline on record since Moody’s Analytics REIS began publishing quarterly data in 1999.

Office Sector – Confusingly, asking rents rose by 0.2% but effective rents fell by 0.2%. Like other markets, office performance metrics appear to be of two minds as it navigates the continuing uncertainty of the COVID-19 crisis.

Retail Sector – Our outlook puts most of the decline in retail rents in 2021 (as well as an increase in vacancy) as more stores are expected to close after the holiday season.

Industrial Sector – This sector continued to defy the broader economic trend of rising vacancies and falling rents due to robust e-commerce sales that continued to increase slightly over the summer despite the re-opening of stores and malls.

Construction Activity – Moody’s Analytics REIS third quarter data continues to show construction activities on hold. Across all major CRE sectors, the completion figures remained around the same level from the first quarter to the third quarter in 2020.

It is troublesome when you see words like “confusingly”, “record pace” and “defy” in an analysis. Other “real time” information available includes;

- We are faced with a resurgence of COVID 19, with many parts of the country con- templating or reentering a shutdown and shelter at home

- Congress has not passed a new stimulus or extending a bank’s ability to push off into the future the decisions regarding downgrades and charge-offs. On paper, at least, the lagging impact of the recession appears to be rearing its head in conjunction with the end of the

- The current election results may mean a shift in the bank regulatory

This is by no means an inclusive list but as can be seen, VUCA analysis may be beneficial for identifying the risks (in this case credit risk) we face and help to point us towards an appropriate strategy for our loan loss reserves and capital levels.

Do I further add to my reserve, reducing my earnings for the year, leave the reserve flat or is it time to reduce the reserve and take some of the reserve back into income?

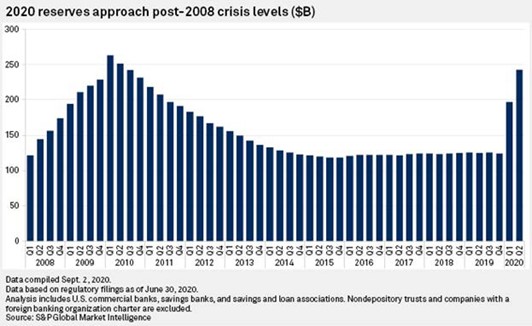

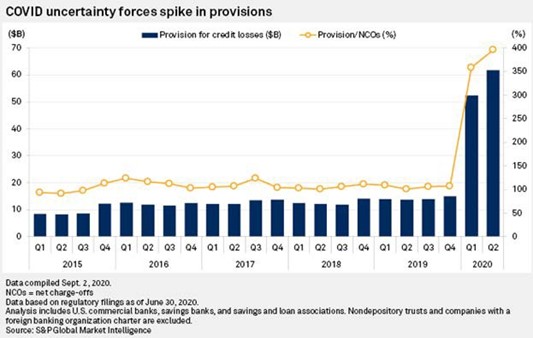

What has been done to date? The following two charts from S&P Global of US loan loss reserves as of Q2 2020 appear to show that financial institutions are prepared for increased losses, with the question now being; Do I further add to my reserve, reducing my earnings for the year, leave the reserve flat or is it time to reduce the reserve and take some of the reserve back into income? This is a tough decision to make and each financial institution must make it based on their analysis of the internal and external drivers.

The second chart indicates that current losses (net charge offs), as applied under both ALLL and CECL, are not at a level to support the reserve that is on the books. This is most likely more true from an accounting perspective than a credit risk view. The reserve, at the end of the day is an accounting and regulatory activity. The problem is that we just do not have historical data for the pandemic and the resul-tant self-induced recession. It’s a little like planning for snow in the Bahamas when suddenly there is snow in the forecast. How do you plan for something that hasn’t happened before? No matter what a financial institution does, it needs to support the decision with analysis and put it in writing. This is especially true at year end when 10 K’s are issued by publicly traded organizations and capital levels get trued up for all financial institutions.

For ALLL financial institutions, the Q factors remain a separate reserve allocation and since losses have (by and large) continued to be low, make up a significant portion of the reserve.

This takes us to our Qualitative (Q) factors. For CECL compliant financial institutions, the Q factors for known risks with appropriate historical data are now embedded in the lifetime loss analysis. For ALLL financial institutions, the Q factors remain a separate reserve allocation and since losses have (by and large) continued to be low, make up a significant portion of the reserve.

How might you use the VUCA analysis in determining the reserve level for Q4 2020? Beginning with a detailed analysis of the current loan portfolio to include the following;

- Current loan portfolio by Many financial institutions segment by call code but it may be time to add an industry classification as well.

- Loans that have been on deferral (and maybe taken off ) should be analyzed for their ability to survive without government

- Stress testing, as I have stated before, is very important in understanding the credits that are at the tipping You should most likely be performing the stress test at least quarterly

- In order to compensate for the “Unknown Unknowns), it may be time to maintain a part of the reserve as unallocated.

Coming up on Q4 2020, the economic, political and credit environment are extremely uncertain with significant complexity and ambiguity as to what will cause the ship to float or to sink. As we have learned over and over, the regulators are not particularly sympathetic when it comes to banks that are in trouble, even if the

troubles are a result of a pandemic for which no one has historical performance data or information. Reserving for the upcoming quarter is perhaps the most challenging quarter ever faced by the financial institution industry. How you address this, both in the amount of the reserve and the documented support of your decision will give you a good footing for continuing to address the crisis and emerge in sound financial shape.

John P. Hurlock

Executive Consultant

CEIS Review, Inc

Related links

- Analysis: Pandemic payment holidays mask wave of European problem debt

https://www.reuters.com/article/us-health-coronavirus-debt-analysis/analysis-pandemic-payment-holidays-mask-wave-of-european-problem-debt-idUSKBN27R16H

- FDIC Issues List of Banks Examined for CRA Compliance https://wfdic.gov/news/press-releases/2020/pr20123.html

- BoE warns banks: start preparing for a higher carbon price

- Chinese vaccine-makers enroll patients in Asia, LatAm for COVID-19 trials https://platform.marketintelligence.spglobal.com/web/client?auth=inherit#news/article?id=61223490&KeyProductLinkType=19

- To offset US sanctions risk, banks bake in China loan clauses