The Federal Reserve System has released their “October 2019 Senior Loan Officer Opinion Survey on Bank Lending Practices” report (1), which addresses the changes in the standards and term on, and demand for, bank loans to business and households over the past three months.

Commercial and Industrial (C&I) Lending

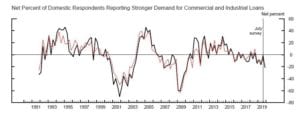

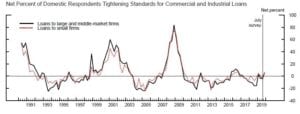

Respondent Institutions have indicated that while they have tightened or adhered to their Institutions stated credit standards, they have experienced weaker demand for C&I loans from the large to middle market ($50MM or greater) borrower space, with a trailing lessened demand from smaller organizations ($50MM or less) as well. Please note that although there are respondents indicating a tightening of standards, the net percentage of Banks indicating such is only 5.4%.

Respondent Institutions indicated the weaker demand for C&I lending could be attributed to (a) tightened lending standards, (b) borrowers relying on their own funds instead of borrowing, (c) a reduced need for M&A funding, (d) and a reduction of borrowers making capital improvements at their respective companies.

C&I Lending Standards – Domestic

Tightening of Lending Standards – Domestic Institutions stated the reasons for tightening of lending standards are (1) a less favorable or more uncertain outlook on the economy, (2) an Institutional reduction in risk tolerances, (3) and a worsening of industry-specific problems.

Easing of Lending Standards – the Institutions that responded with an ease of standards indicated the ease was due to a highly competitive environment.

C&I Lending Standards – Foreign Banks

Foreign Branches reported a less demand for C&I within 3Q19, while also a tightening of their lending standards, with some reporting an increase in premiums charged for riskier borrowers/loans. Foreign Branches that have reported tightened standards echo the rationale that domestic lenders shared, with the addition of decreased liquidity in the secondary market as playing a factor in their lending standards.

Commercial Real Estate (CRE) Lending

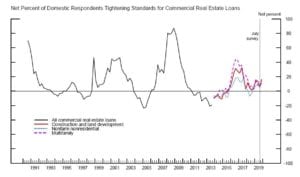

Banks have reportedly tightened standards on all types of CRE loans. A modest amount of Banks have indicated that they have been experiencing weaker demand for construction and land development loans, while the majority of Banks reported that demand was unchanged for loans secured by non farm nonresidential and multifamily properties and balance.

To view the full Senior Loan Officer Opinion Survey, select here