Click to download full PDF here.

Loan Quality 1

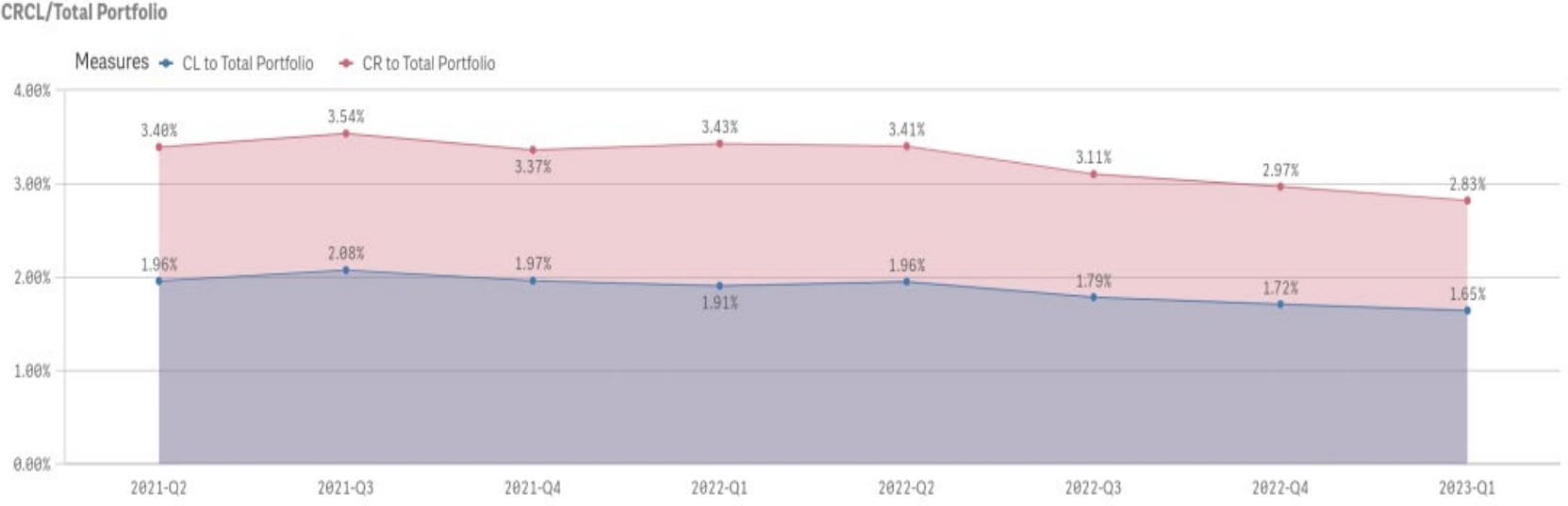

Criticized Segment – The average level of criticized loans to portfolio continued to decline to 2.83% at Q1 2023 compared to 2.97% at Q4 2022 and 3.43% one year earlier at Q1 2022. Classified loans relative to portfolio also declined to 1.65% at Q1 2023 compared to 1.72% at Q4 2022 and 1.91% one year earlier at Q1 2022.

Over the last eight quarters criticized loans relative to portfolio ranged from 2.83% to 3.54% while the ratio of classified loans to portfolio ranged between 1.65% and 2.08%.

Defined as the sum of Special Mention, Substandard and Doubtful

Defined as the sum of Substandard and Doubtful

Source: CEIS Data for All Banks

Loan Quality 2

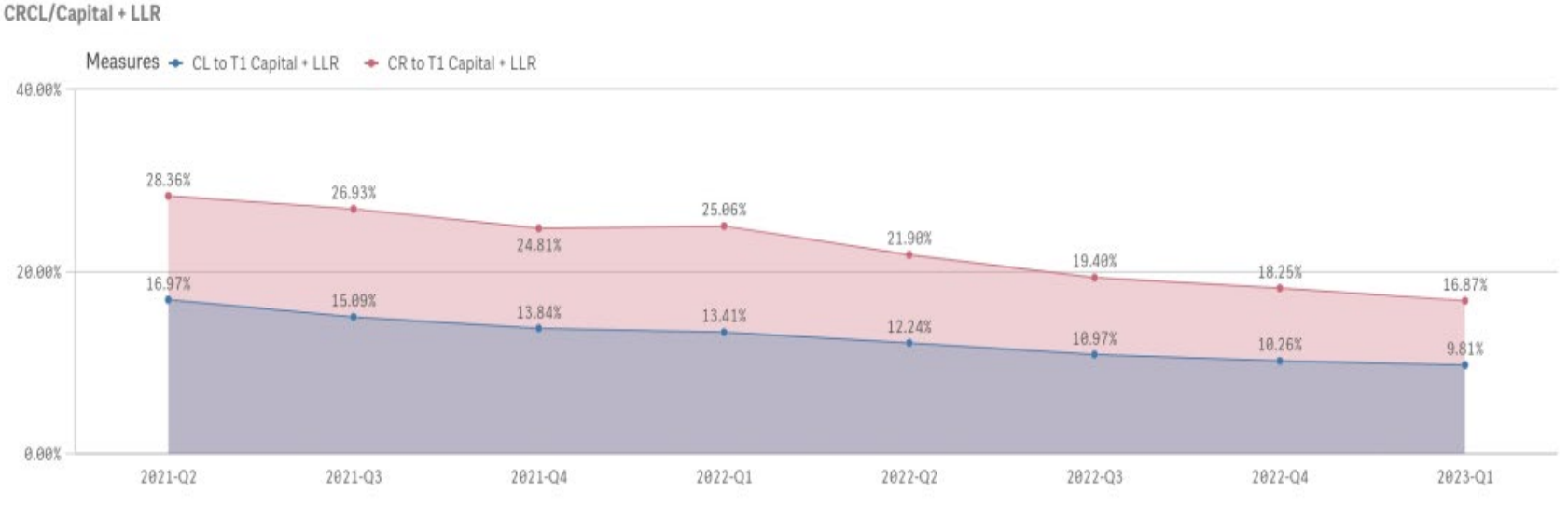

Criticized Segment – Criticized loans to Tier 1 capital plus loan loss reserves continued a downward trend from 28.36% at Q2 2021 to 25.06% at Q1 2022, and further to 16.87% at Q1 2023. The more critical ratio of classified loans to Tier 1 capital plus loan loss reserves also decreased from 16.97% at Q2 2021 to 13.41% at Q1 2022 and to 9.81% at Q1 2023.

Over the last eight quarters criticized and classified loans relative to Tier 1 capital plus loan loss reserves ranged from 16.87% to 28.36% and 9.81% to 16.97%, respectively.

Source: CEIS Data for All Banks

Provisions for Credit Losses, Reserves and Net Charge-Offs

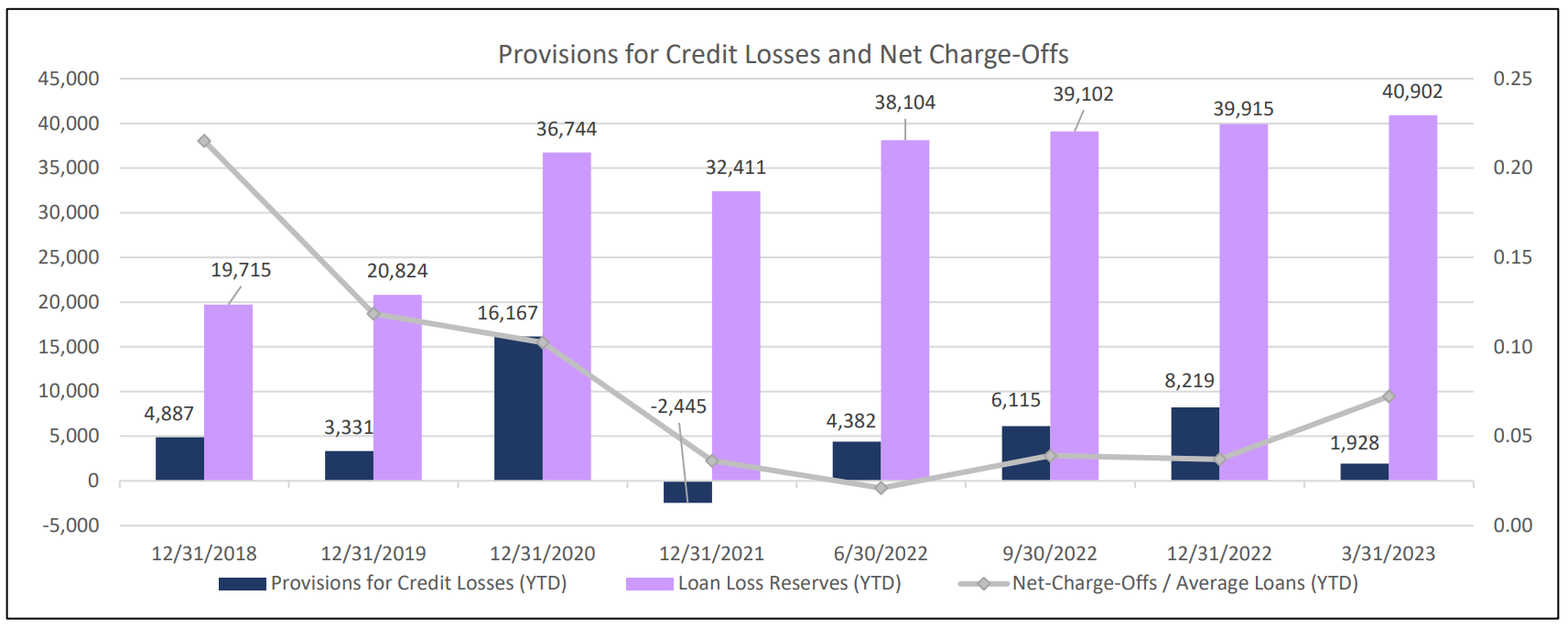

Provision / Reserve – The provision for credit losses for the CEIS client base dropped notably from FYE20 to FYE21 and then reflected an increase through Q4 2022. However, the average provision showed a decrease in Q1 2023. Loan loss reserves for the group continued to exhibit an increasing trend since Q4 2021. Net charge-offs increased from an annualized 0.04% of average loans at Q4 2022 to 0.07% at Q1 2023 but remains below the 0.11% reported at FYE20.

Reserve coverage of classified loans declined slightly to 90.00% at Q1 2023 from 97.91% at Q4 2022 and 97.59% at Q3 2022. Over the prior eight quarter period, loan loss reserves to classified loans in the CEIS client base ranged from 77.47% to 98.25%

CEIS is an independent consulting firm established in 1989, serving the needs of organizations with general and/or specialized commercial loan portfolios.

Loan Review, ALLL / LLR Methodology and Validation, Portfolio Stress Testing, Portfolio Acquisition Review, Leveraged Lending Review, Municipal and Public Finance Review, Loan Policy Maintenance, Process Review, and Customized Loan and Credit Seminars.

(888) 967-7380

[email protected]

www.ceisreview.com

Joseph J. Hill – [email protected]

Elaine M Cottrell- [email protected]

Justin J. Hill – [email protected]