Creating an Effective Credit Policy for your Institution – The CEIS Quarterly – Newsletter, Issue 2 Volume 1

Select here to download The CEIS Quarterly Volume 1 Issue 2

On My Mind…CEIS’ President, Joe Hill, shares his thoughts on the current banking environment

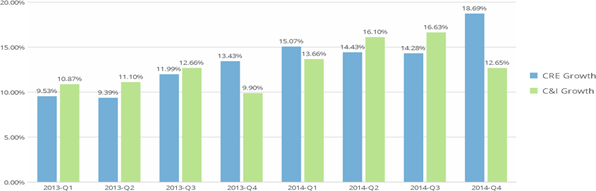

In CEIS’ recent Quarterly Client Survey, we noted that community banks in our client base are nearly all showing growth, an observation which is further supported by the various data releases on the related industry segment from the Bank Regulators. Based on the data thus far compiled, the growth rate appears to be increasing particularly in the real estate segment as indicated in the following graph on CEIS’ client base that shows the 12 month change for comparative year-over-year periods:

CEIS’ Client Base YoY

CEIS’ findings show that portfolio quality has not deteriorated in the face of increased loan growth. Nevertheless the true test is always time. There are a new transactions in portfolios that represent new borrower relationships at many banks that have not gone through the test of adversity. The stress here is to continue to maintain a high level of credit underwriting standards so as to maintain a sound overall credit portfolio on a going forward basis. The Bank Agencies while noting that loan quality is currently sound, have also remarked that there is an easing of underwriting standards with accelerated loan growth and therefore increased credit risk evident in loan portfolios.

Joseph J. Hill

Regulatory Releases

Recent releases which pertain to our clients

OCC – Thomas Curry addressed efforts to ease the burden of regulation on community banks.

OCC – Financing Small Multifamily Rental Properties

Interagency – Final Rule on Minimum Requirements for Appraisal Management Companies

Managing Director Mr. John P. Macukas

This quarter we would like to spotlight Managing Director Mr. John P. Macukas. John overseas CEIS’ Leveraged Lending/Structured finance engagements. Under John’s supervision a team of reviewers which are very experienced in these types of credits perform the diligence either at inception of such a transaction, or as an ongoing credit quality monitoring system for the invested party. CEIS’ provides detailed reviews and assessments of Leveraged Lending and similar complex credits providing client’s reports which document the review of the critical issues and directives from the Bank Regulators and the considerations of our clients’ issues.

To view John’s bio and contact information

Creating an Effective Credit Policy

By: Mr. Christopher “Kit” Webbe

The Credit Policy is rarely a popular subject of conversation. However, it is the principal means whereby the Board of Directors, as representatives of ownership, establishes the credit culture of the bank. It establishes the bank’s appetite for risk, it fixes how much of and to what levels decision-making discretion has been delegated within the organization and it determines how the bank will measure, monitor, control and report the amount of risk inherent in the bank’s loan portfolio. It is relatively rare for a bank totally to re-write its Credit Policy. It is, however, amended from time to time. This can happen as a result of the introduction of a new product, of the implementation of a new set of controls or of a change in the bank’s organization. It is hard to maintain the integrity of a complex set of directives which is subject to periodic modification, yet if they are to do their job it is vital that this set of directives be kept up to date, that the meaning of its content be readily comprehensible, and that it be strictly enforced. Here we offer some thoughts about how these objectives can be attained.

1) Policy, not procedure

The content of each Credit Policy will be designed to meet the needs of its institution. It will in that sense be unique to that institution and there can be no standard policy that meets all needs. However, decisions made as to what will and will not be included can make a difference as to how the policy is used and how effective it is. Try to ensure that the policy is aimed at “what” rather than “how”. Too often, policies are filled with precise instructions on how routine duties are to be carried out. The documents become large and unwieldy and because of their size it is harder to locate specific guidance. These “how to” instructions are also more likely to be subject to frequent change, whereas, as we shall see later, we really want to keep policy changes down to a minimum. The best solution is to put the “how to” instructions in a separate manual and cross reference where appropriate. The bank may well decide that responsibility for the amendment of such ancillary manuals can be delegated to the bank’s management, thus dispensing with the need for the Board to sign off on every change, as they will have to do where amendments to the Credit Policy are concerned.

2) Clarity

Wherever possible, be exact and use concrete terms. Avoid such terms as “Generally,” “Usually,” and “under normal circumstances”. Policies and the circumstances under which they apply need to be clearly described. When “general” words are used, it may not be clear in a given circumstance whether the policy does or does not apply. This makes it impossible for those whose responsibility it is to ensure that policies are enforced to do their job. It also increases the danger that significant time, effort and expense may be invested in bringing business to the level at which it is to be approved only to have it turned down because the approver has a different opinion as to the applicability of a policy. Every time wheels spin; it costs the bank money. Frequently those whose responsibility it is to bring in business will seek to soften policies by introducing such “generalizing” language. Resist this tendency. No policy can cater for every conceivable set of circumstances, and it is certainly no part of the purpose of a Credit Policy to prevent the bank from booking acceptable risk. However, instead of allowing flexibility, utilize the exception process. If an officer believes that in a given case there are grounds for justifying an exception, then the offering memorandum should incorporate a request for specific approval of the exception in question (see Exceptions below), with a full explanation as to why in the given case an exception is justified.

3) Keeping it current

Most banks these days make a point of ensuring that their policies incorporate the latest regulatory guidance and reflect the business the bank does. Banks are less good at making sure that dated material is removed. Guidance on products the bank no longer offers, regulatory or legal requirements that have been withdrawn or superseded, and indeed references to functions and departments in the bank that have been changed or no longer exist, frequently linger on past their due date. For the most part, they do little harm, but their existence brings the overall policy into disrepute. It suggests that if there are some elements of the policy that clearly do not apply, perhaps other parts of the policy are equally optional in their application. The policy should contain no elements that serve to cast doubt on its authority.

4) Organization

Back in the days before computers and networks, as with all the other policies in the bank the Credit Policy had to be printed. Keeping track of the copies and making sure they were kept up to date was a significant task. And then of course people would photocopy sections of the policy or even whole policies, which then didn’t get updated with subsequent amendments so different versions of the same policy would exist simultaneously. Now most banks have a single version of the policy available on the network for anyone to consult, relieving the bank of the burden of keeping multiple copies up to date. In order to avoid the existence of out-of-date versions, you should discourage your staff from downloading copies from the network. Also, it is good practice to have every page of the policy carry the version and date under which it was issued so that no argument can arise as to which part of which policy came into force on what date. As an added benefit, you can then quickly determine which sections of the policy have gone the longest without being reviewed and may, therefore, be the most likely to contain obsolete material. Finally, break your policy up into independently page numbered sections. If you have a single paging arrangement, every time you amend the policy the document will repaginate. Unless you have automated your index, it is going to have to be revised each time an amendment is adopted. If the policy is organized into separate sections, then only the part of the index concerned with the amended section needs to be updated.

5) Access

In the past, problems of access discouraged people from using the Credit Policy. It was regarded as a highly confidential document and as such was usually kept under lock and key. Once you managed to get hold of a copy, you then had to find what you were looking for, which was not always easy, especially if the policy was several hundred pages long. There was a natural reluctance to spend valuable time leafing through the policy trying to determine whether a specific circumstance was covered. Today, with the policy accessible via the network, the process can be made much easier. Firstly, you can set computer privileges so that only those with a need to consult policies have that ability, which takes care of the confidentiality issue without impacting ease of access. Secondly you can make sure that the policy is searchable so that users can use key words to narrow the search. Thirdly, you can make sure the policy has a comprehensive index, which again helps the user to focus his/her search. An additional step is to have teh document hyperlink each item in the index connected to the material it points to, thus speeding up the process of locating the information you are searching for. Make the policy easy to access, and you will find that it makes the Credit Policy a more useful and effective management tool (and you may get additional approval from the regulators.)

6) Amendments

Try to make sure these do not occur too frequently. Of course legal and/or regulatory directives must be acted upon without delay, and other circumstances may make prompt action desirable. However, frequent amendments can have an unsettling effect on an organization. Having to familiarize themselves with new guidelines places additional stress on your officers. Frequent policy changes also might lead one to question whether an organization is clear as to the direction it should be taking. Moreover, as already mentioned, policies have to go to the Board of Directors for approval. This means putting in motion a process whereby once drafted the amended policy must receive appropriate approvals prior to Board submission, a process that can be overly time-consuming and administratively burdensome. It is suggested in particular that material that is likely to change on a more frequent basis should be included in a form that can accommodate those changes. For example, where duties or responsibilities are assigned, they should be designated to a title or position, and not to an individual by name. Thus, for example, a modification in the collateral arrangements for a loan might require the consent of the senior credit officer, not that of John Smith who happens to be the current in cumbent. Some banks prefer to assign discretionary powers to individuals rather than positions – if that is the case it is preferable to establish an appendix to the policy to which the policy refers and which can be updated from time to time without affecting the body of the policy. An additional suggestion is that when a significant Credit Policy change has to be made to accommodate the introduction of a new product, or the implementation of new regulatory guidance, that a draft form be issued first. This allows some time to elapse which will shoe evident any unforeseen affects the new changes may affect. After such, a final amendment can be arrived at thus eliminating the reiteration of several final policy changes that can create confusion internally. After all, you do not want be presenting a whole series of policy amendments to cover these adjustments as they arise, so consider the benefits of introducing a procedure whereby such guidance can be published draft form first, to be fine tuned as a formal amendment to policy after, say six months, by which time the wrinkles should be ironed out.

7) Exceptions

As we have discussed, it is infinitely preferable to have specific, clearly written policies, and then accommodate the occasional exception than it is to have loosely described policies which may or may not apply depending on a set of undefined circumstances. There are additional benefits to a well-managed exception process. Every exception granted is a case where the Credit Policy has been tested and found wanting. Management can gain useful knowledge from tracking exceptions. For this purpose, it is essential to establish an exception register, which should capture the nature of each exception and, to the extent possible, the surrounding circumstances. Note that both approved, and unapproved exceptions should be included. This register should be reviewed periodically (at least once a year). Repeated exceptions in a given area of policy will suggest that the policy is out of step at least with the expectations of the bank’s customers, and possibly with the industry at large. Lack of exceptions may equally suggest that the bank’s policies are not as tight as they might be. Either way, the exception process can provide important insight into the current state of the market and the bank’s position in that market, and the bank can use the input in decisions on whether or not to update the policy.

8) Writing your policy

As noted above, credit policies are rarely re-written from scratch. If you do decide to embark on a total re- write, one important decision you will have to make is whether to handle the job in-house or whether to contract it out. Doing it in-house means that the policy will have the benefit of being prepared by someone with intimate knowledge of the way in which the bank works. It will more nearly reflect the credit culture of the bank than any external customized off the shelf product can do. On the other hand re-writing the policy is not an insignificant task, and smaller institutions may not have the necessary resources. Employing an independent consultant to do the job also has its pros and cons. Consultants will be aware of the latest rules and regulations and will make sure they are included. A consultant will be aware of best practices and drafting techniques, and the quality of the product may, therefore, exceed that of an in-house rendering. A consultant can be held to an agreed delivery date. A consultant’s product should contain all the desired clarity and consistency required. And while time and effort may be required in making sure the consultant is fully briefed on what the end product should contain, those discussions may also provide a useful opportunity for the bank to reassess the adequacy of its policies. On the other hand, a consultant may have a tendency to bring a “one size fits all” approach to the task, and it may not be until the policy is actually implemented that the shortcomings of the product become apparent. As a general guide, the more complex and multi-faceted your operations, the more likely that going with a consultant will be your best choice.

Conclusion

Banking is becoming an ever more competitive and complex business, and effective management is an ever increasing challenge. It is essential that the Board of Directors and senior management provide clear, accessible and comprehensive guidelines to the staff. The Credit Policy is an effective means whereby lending risk guidelines can be communicated. A well-designed, well-maintained and easy to use Credit Policy can play a significant role in helping a bank achieve its goals. A Policy that is unsatisfactory in any one of these respects is likely to have an adverse impact.

Mr. Christopher “Kit” Webbe

This Quarter’s issue shares some of Joe Hill‘s thoughts on the current banking environment, a spotlight on Managing Director Mr. John P. Macukas, and an article discussing Creating an Effective Credit Policy for your institution.

Select here to download The-CEIS-Quarterly-Volume-1-Issue-2