In the article below, CEIS’ experts, Mr. Christopher “Kit” Webbe and Ms. Elizabeth Williams, examine the topic.

I) Introduction

The risks posed by concentrations of credit risk in general, and Commercial Real Estate concentrations in particular, have long been an area of focus for bank regulators. In 2006, the FFIEC published the Interagency Guidance “Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices” (1), which outlined regulators’ expectations for a risk management framework to manage the risk associated with Commercial Real Estate (CRE) concentrations. In December 2015 the regulators issued the “Statement on Prudent Risk Management for Commercial Real Estate Lending” (2) which served as a “reminder” regarding expectations for managing concentration risks. The regulators observed trends in the easing of CRE underwriting standards and made it clear to the banking community that regulators will be actively reviewing bank compliance with these requirements during 2016.

The purpose of this paper is to provide a high level summary of the 2006 regulatory guidelines and to review current areas of examination focus. The paper will provide an overview for those who are not directly involved in the implementation of measures to comply with regulatory guidance on CRE concentration risk management and serve as an aide memoire to those who are. Those familiar with the guidance will be aware that there is a requirement for awareness and involvement of the Board of Directors in the process. This paper may be helpful in that context. It should be noted that detailed advice on the implementation of the measures outlined by the regulators is beyond the scope of this paper. Institutions seeking such assistance are encouraged to contact Liz Williams, Managing Director, CEIS Review (212-967-7380).

II) Guidance

The 2006 Guidance (3) notes that the CRE sector is vulnerable to business cycles. Banks need to have appropriate risk management practices in place and adequate capital to manage through these cycles. Key elements of risk management include identification of concentrations, board/management oversight, active portfolio management, management information systems, market analysis, underwriting standards, stress testing/sensitivity analysis, and credit risk review. In summary, the Guidance noted that “regardless of its size, an institution should be able to identify and monitor CRE concentrations and the potential effect that changes in market conditions may have on the institution.”

Identification of Concentrations

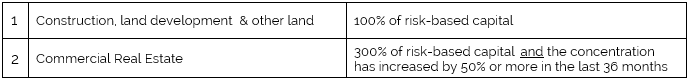

Regulators have established two thresholds that will assist them in determining the level of a bank’s CRE concentration risk. They are:

The category “Commercial Real Estate” is intended to include properties where 50% or more of cash flow is from third parties or where bank depends on sale of the property or permanent financing for repayment. Specifically also included are loans to REITs and unsecured loans to developers if for real estate. Specifically excluded are loans secured by farm property, commercial owner-occupied premises and residences where cash flow comes from the resident’s cash flow. Regulators emphasize that the thresholds are not to be regarded as limits. The thresholds are intended to be benchmarks, above which the regulators would expect to see components of the risk management framework outlined in the Guidance. At the same time, a bank does not obtain exemption from potential supervisory attention by being below the threshold limits (i.e. the thresholds do not constitute “safe havens”).

Different types of real estate carry different risks (4). Banks need to be able to segment portfolios by stratifying the portfolio by risk characteristics and by sensitivity to economic, financial or business developments in order to be able to measure and manage risk. In this connection, it is worth noting that the widely accepted industry definition of a concentration is one that exceeds 25% of the institution’s capital. However, clearly a much larger percentage may well present little threat to the organization while a smaller one may contain substantial embedded risk. Materiality is therefore an important consideration in defining concentrations and the risk they pose. Also, banks should be alert for correlation of risk between segments and be ready to combine those segments for risk management purposes.

Board and Management Oversight

Guidance emphasizes the importance of both management and the Board being involved in the process. The Board should establish policy guidelines and lending strategy for Commercial Real Estate lending (by type of property/transaction if appropriate). It should ensure that the strategies mesh with the bank’s overall plan. The Board should require management to implement procedures and controls that will ensure adherence to those policies and strategies. It should also require management to provide ongoing information that identifies and quantifies CRE risk and changes in CRE market conditions. The Board and management should then use this information determine whether the Bank’s strategies and policies (including limits and sub-limits) remain appropriate in light of current market conditions.

Management Information Systems

In order to be able to identify, measure and monitor CRE risk a bank will need to have adequate management information systems in place. The MIS must be able to report necessary information on both a periodic and an ad hoc basis. The system needs to be reviewed from time to time to make sure that it remains adequate in light of changes in policy, changes in the complexion of the portfolio and of changes in the market.

Specific data the regulators indicate should be captured include property type, geographic market, tenant concentrations, tenant industries, developer concentrations and risk rating. They suggest also loan structure (fixed/adjustable), purpose, LTV, DSC, policy exceptions, borrower concentrations (including affiliated loans.) Given the regulators’ current focus on potential easing of underwriting standards, reports highlighting trends in key metrics by origination quarter or “vintage” are useful tools to demonstrate monitoring of this issue. Banks are also instructed not to ignore derivative risk. A process should be in place to ensure that periodic and hoc reports from the MIS are formally reviewed. The system should provide the means of reviewing both current data and the extent to which measurements have changed over time, including risk rating migration.

Market Analysis

The regulators note that “the important objective is that an institution should have the information necessary to assess the potential effect of market changes on its CRE portfolio and lending strategy.” They observe that a bank needs to be able to “demonstrate that it has an understanding of the economic and business factors influencing its lending markets.” The bank will be expected to analyze the market by property type and by geography. This is particularly important when the bank is planning to enter new markets but is also critically important in assessing changes in market conditions in areas where the bank has long had a presence. Market data will also be used as a factor in sensitivity analysis and stress testing. Market risks that Guidance focuses on specifically include demand, changes in cap rates, vacancy rates and rents. Banks are encouraged to tap such sources as publicly available statistical data, appraisers, agents, tax authorities, contractors, investors and community development groups.

Credit Underwriting

Underwriting policies should reflect the bank’s appetite for risk. They should be clear and precise, and compliance should be measurable. Policies should address internal factors such as historical experience, staff capabilities and technological resources, and external factors such as market position, the bank’s existing/future trade area, and trends in lending and funding.

Policies should specifically establish the maximum exposure by loan amount and by type of property, as well as appropriate loan terms, pricing, LTV, requirements for feasibility studies and/or sensitivity/stress testing, minimum hard equity contribution from the borrower, minimum borrower net worth, cash flow and debt service coverage, and collateral valuation (i.e. compliance with appraisal regulations). Analysis should address the overall financial condition of the borrower as well as focusing on the specific project. Where construction loans are concerned, controls should be in place to make sure equity is contributed and maintained, and an inspection process should document construction progress, track pre-sale/pre-leasing and exception monitoring and reporting.

Policies should include exception-handling procedures. Permitted exceptions should be infrequent, with documentation of appropriate mitigants and should be approved at the required level. Exceptions to policy should be reported regularly to the Board and senior management. This reporting should include trends in the level of exceptions and percentage of new / renewed underwriting with exceptions.

Stress Testing/Sensitivity Analysis

While most banks include some level of stress testing as part of the underwriting process for individual loan exposures, banks with CRE levels in excess of the regulatory thresholds are expected to analyze the impact of changes in market conditions or interest rates on the portfolio as a whole. Of course, the complexity of stress testing/sensitivity analysis should reflect the complexity and riskiness of the portfolio. The analysis can help to identify the effect of potential market conditions on portfolio segments and especially the more vulnerable segments. It should focus on the overall effects of changing market conditions and their impact on asset quality, capital and earnings. Analysis of capital levels in stressed scenarios can provide significant support for justifying an existing CRE concentration, or for supporting a proposed increase in such a concentration.

Portfolio Management

Regulators expect to see strategies in place for managing the concentrations that have been identified. Such strategies may include adjustments in credit risk rating, contingency plans to limit or reduce exposure through sales, participations, and/or securitizations, as well as use of derivatives. Note that “if an institution depends on the secondary market as a means of reducing exposure, then it should evaluate the ability to do so and compare underwriting standards with those of the secondary market”.

III) December 2015 Statement

The Statement on Prudent Risk Management for Commercial Real Estate Lending (5) issued in December 2015 draws attention to growth in CRE portfolios, declining CAP rates and rising property values and the lack of negative signals from vacancy and absorption rates and levels of non-performing loans and charge offs. Regulators note that competition is driving easing of standards (covenants, maturities, IOs, limitations on guarantees). They observe increasing occurrence of exceptions at some institutions as well as insufficient monitoring of market conditions.

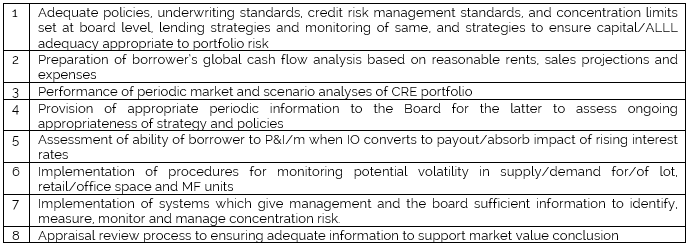

A large part of the statement is given over to reminding banks of the requirements under the 2006 guidance, noting that institutions which succeeded during the downturn had essentially complied with the Guidance requirements, including:

The Statement then instructs banks to review CRE policies and practices and to maintain risk management practices and capital levels commensurate with the level and nature of CRE concentration. The Statement draws attention in particular to maintaining underwriting discipline.

The statement then notifies the banks that “During 2016 supervisors from the banking agencies will continue to pay special attention to potential risks associated with CRE lending.” When conducting examinations that include a review of CRE lending activities, the agencies will focus on financial institutions’ implementation of the prudent principles in the Concentration Guidance as well as other applicable guidance relative to identifying, measuring, monitoring and managing concentration risk in CRE lending activities. The agencies may ask financial institutions found to have inadequate risk management practices and capital strategies to develop a plan to identify, measure monitor and manage CRE concentrations to reduce risk tolerances in their underwriting standards or to raise additional capital to mitigate the risk associated with their CRE strategies or exposures.”

IV) Current Areas of Supervisory Focus

While regulators may review any bank portfolio for signs of CRE concentration, they expect particularly to focus on banks with CRE portfolios that have grown quickly, banks with CRE portfolios that include high risk segments, and / or banks whose CRE portfolios are approaching or have passed the regulatory thresholds. In assessing risk, regulators will focus on diversification, geographic dispersion, underwriting standards, guarantees, level of pre-sale/pre-lease or other identified take out, and portfolio liquidity (ability to reduce exposure). In particular, examiners are expected to focus on current market conditions and the quality of recent new / renewed underwriting, as well as on management’s and the Board’s efforts to monitor trends in this area.

Assessments of capital adequacy may have a particular role where compliance with CRE risk management guidance is concerned. Regulators will review the quality of the bank’s CRE risk management framework, encompassing the areas outlined in this paper, and assess the adequacy of capital levels relative both to (1) concentration levels and (2) to the bank’s management of this concentration risk.

Banks with significant growth in CRE and which either currently exceed the regulatory benchmarks for a CRE concentration, or which are likely to exceed these levels in the near future, are encouraged to review their policies and processes to ensure that their risk management framework includes the components outlined in the 2006 and 2016 regulatory publications. To the extent that some components have not yet been addressed, recommend documentation of a plan (including a timeline) for implementation.

Citations:

(1) https://www.federalreserve.gov/boarddocs/srletters/2007/SR0701a2.pdf

(2) https://www.federalreserve.gov/newsevents/pressreleases/files/bcreg20151218a1.pdf

(3) https://www.federalreserve.gov/boarddocs/srletters/2007/SR0701a2.pdf

(4) https://www.occ.gov/publications/publications-by-type/comptrollers-handbook/concentrations-of-credit/pub-ch-concentrations.pdf

(5) https://www.federalreserve.gov/newsevents/pressreleases/files/bcreg20151218a1.pdf