A negative grade migration has been slowed down due to COVID-19, while borrowers with delays has led to increased exception levels.

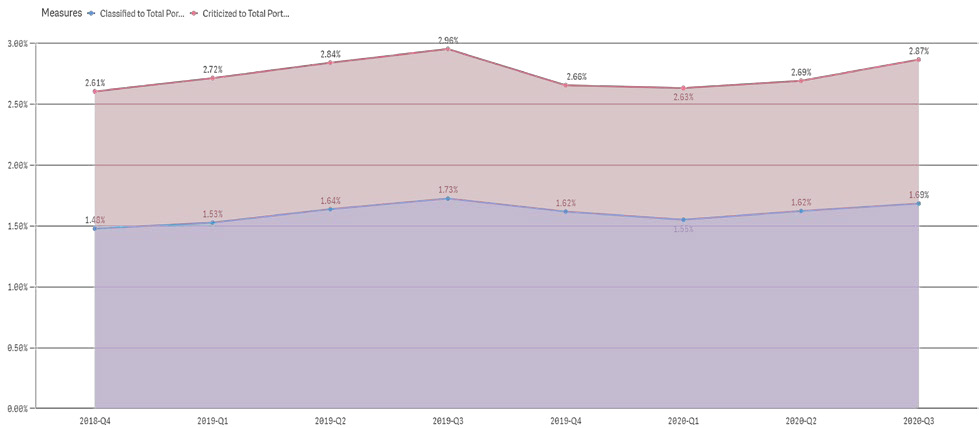

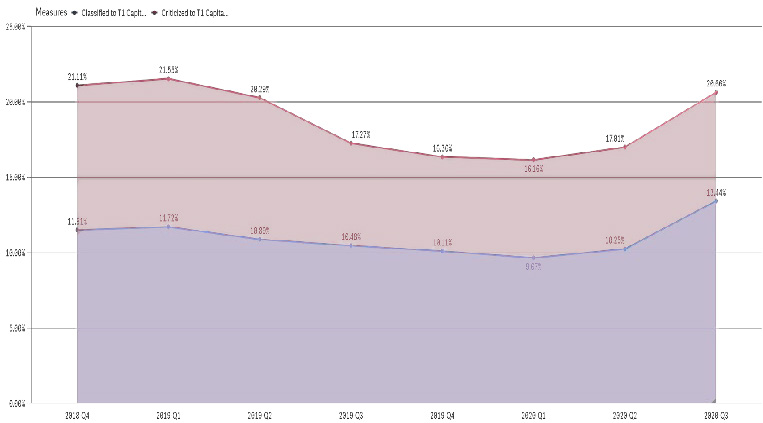

New York, NY- CEIS Review has recently begun to observe stress’s being applied to commercial portfolios reflected within our aggregated portfolio findings. CEIS’ internal Loan Portfolio Quality Statistics (“LPQS”) are beginning to show a modest – to moderate increase, in the criticized and classified loan level ratios relative to total portfolio outstanding’s as outlined below. This gradual rise alone is not too meaningful, but coupled with the knowledge of increasing borrower delinquencies, additional loan modifications taking place, and additional community lockdowns being enforced may present a different picture.

While initially modest, the developing trend line above indicates that the increases have occurred during the most recent three quarters, and the quarterly rises have become more pronounced as additional quarters elapse. This observation as well as CEIS’ industry knowledge has led to the internal consensus that this trend line will become more aggressive over the next six to twelve months as assets are re-classified.

At this time of this writing, loan quality ratios are generally within the parameters of what meets the definition of a “satisfactory” portfolio. Portfolios managers should start to receive more current financial information from borrowers, that coupled with 2020 YTD data may prompt risk rating changes and potentially TDR status consideration.

A further thought regarding the TDR topic is that – CEIS has observed that negative grade migration has been slowed because of Bank’s maintaining Pass grades for borrowers who have received COVID-19 modifications, and when these modifications expire (typically 6 months), and borrowers are then unable to service their debt, this could potentially lead to an uptick in downgrades forced by post modification delinquency period, and potential non-accrual. A major caveat to this statement is the unknown longer-term effects of Federal Relief programs.

CEIS has observed and increase in borrowers with Reporting Requirement Exceptions/Delays YoY (27% – 35%), which has led to an increase in covenant non-compliance with the stipulated time deadlines for reports. We also observed that some institutions do not test compliance upon receipt of the financial data but only at the time of the scheduled annual analysis creating possibility of delay in recognizing slippage in the current pandemic period. We find that many community bank portfolios are dependent on tax returns for the real estate segment; however, without rent rolls or income & expense statements, the tax returns when received and their compliance with covenants, are already stale in the current environment.

New and Renewed Loans are showing an increase in Credit Policy Exceptions over the prior two quarters, and while many of the exceptions have been offset by mitigating factors, Institutions may want to review their policies considering the current environment as eventually those mitigating factors will either not be present for the borrower/facility (i.e., Govt. Relief), or they will no longer be acceptable or valued as mitigating factors.

Troubled loans are clustered in the retail and hospitality sectors, with multifamily following closely behind. Commercial real estate’s darling, multifamily, has recently been reporting a 25%+ increase in rental delinquencies. Such an increase questions the reliability of Debt Service Coverage Ratio’s that are based on 2019 NOI’s and/or rent rolls.

Parting thoughts – CEIS advises Institutions to reach out their borrowers to receive updated financials (YTD) and to reassess each borrower’s risk rating upon receipt and analysis of those updated financials, and to continue this effort on a heightened frequency during these times so that any unforeseen issue is more readily identified.

For more information, please contact Justin J. Hill, at [email protected], 888.967.7380 ph. – 212.967.7365 fax. For more information online please visit wwwcesireview.com.