FDIC Concerning Community Bank Performance – The CEIS Quarterly Newsletter Issue 4, Volume 3

To view as PDF select here.

New York, November 3, 2017 — CEIS Review Inc., a financial consulting firm serving the needs of commercial and savings banks, examines Community Bank Performance throughout 2Q 2017 as reported by the FDIC.

ON MY MIND…CEIS’ President, Joe Hill, shares his thoughts

Throughout 2Q 2017, Community Banks performed exceptionally well, and better overall than Noncommunity Banks on several measures. We’ve summarized the FDIC’s quarterly reporting on Community Bank performance below. Metrics examined are (a) Aggregate Net Income, (b) Net Interest Income, (c) Loan Balances, (d) Small Loans to Businesses, (e) Noncurrent Rate, and (f) Net Charge-off Rate.

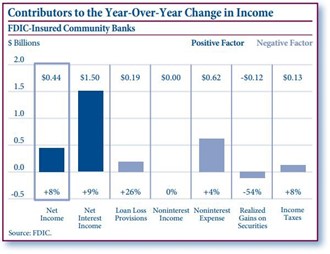

AGGREGATE NET INCOME

Aggregate Net Income increased at 62% of Community Banks, and 8.5% overall, from $5.2b to $5.7b. Looking at year-over-year numbers, Net Income is 8.9% higher now than in 2Q 2016. Banks reporting negative Net Income comprised only 4.3% of the total, which is the lowest level since 2Q 2007.

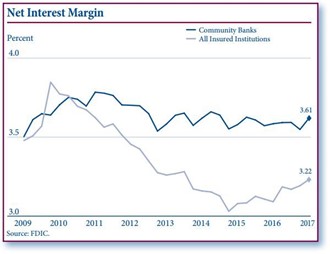

NET INTEREST INCOME

A major contributing factor to the substantial increase in Net Income was the 8.9% increase in Net Interest Income. The overall increase in Net Interest Income was led by interest earned within commercial real estate loans (non 1-to-4 family real estate) up 12%, or $920.6mm, year-over- year. Noninterest income, however, remained flat while 66% of community banks reported a higher noninterest expense, which increased 4.3% overall year-over-year. The increase in noninterest expenses were driven mainly by a 2.2% increase in full-time employees.

LOAN BALANCES

68% of Community Banks experienced a year-over-year increase in their loan balances, with an overall growth rate of $111b, or 7.8%; comparatively, among Noncommunity Banks, loan growth increased at 3%. Driving factors behind this increase were led by an increase in nonfarm nonresidential loans (up 10.8%), 1-to-4 family residential mortgages (up 4.4%), and commercial and industrial loans (up 7.7%).

SMALL LOANS TO BUSINESSES

Small loans to businesses are a significant part of Community Bank’s service to the community; 43% of all small loans to businesses are through Community Banks. Small loans to business increased 2.6% from the previous year, up to $296.9b from $289b in 2016. Factors driving the yearly increase were nonfarm nonresidential loans (up 2.7%) and commercial and industrial loans (up 3.4%). Noncommunity Banks reported an annual decline of .3%.

NONCURRENT RATE

A significant portion (52%) of Community Banks reduced their noncurrent loan balances from the previous quarter, and overall the noncurrent rate dropped to .94% – the lowest level since 2Q 2007. Every loan category experienced an improved noncurrent rate from the previous quarter. Notably, commercial and industrial loans had increased for seven consecutive quarters, but have decreased from last quarter.

Joseph J. Hill President & CEO

REMOTE REVIEW & YOU

It’s no secret that within the banking industry and in the world in general, both businesses and consumers are increasingly using digital tools to get things done faster and more simply. Here at CEIS, we have seen firsthand an increase in use of digital files at Client Banks. Consequently, this has allowed for improved remote review capabilities, whether the review is partially or fully remote.

We thought it is worth mentioning that there are several scenarios where remote review might be a more efficient manner of expediting the reviews. Depending on the portfolio size, portfolio type, and issues possibly unique to the client, we can draw up scenarios that combine advantages of both the on-site and remote review.

We believe that on-site presence at some reasonable level during the year’s review cycle is necessary and is one measure of good practice. However, adding the remote aspect to the process adds efficiency to the practice. In that regard, CEIS suggests that the process can be structured over a year’s review cycle to include both on-site review as well as remote review.

We believe that on-site presence at some reasonable level during the year’s review cycle is necessary and is one measure of good practice. However, adding the remote aspect to the process adds efficiency to the practice. In that regard, CEIS suggests that the process can be structured over a year’s review cycle to include both on-site review as well as remote review.

Cases where we are currently completing remote reviews include the client establishing a ShareFile or other secure encrypted means for CEIS to access pertinent information. In other cases, the client bank provides CEIS with an encrypted CD or USB flash drive that contains the files to be reviewed. If there are additional materials needed for the review that are not in the share files or portable drives, the CEIS reviewer would contact the appropriate person for that information.

If you would like to explore these possibilities, please contact Justin J. Hill ([email protected]) for more information.

“SMALL BUSINESS LENDING: A (MOSTLY) TRUE STORY”

Some years ago, I worked in the credit department of a New York bank. Having expressed interest in getting involved in C&I lending, I was given a small business portfolio to manage. One of the borrowers, “Jim’s company”, was part of that portfolio. The company designed and distributed teen fashions. He purchased the rights to some cartoon characters and his business consisted of designing clothes around these characters, getting the clothes manufactured in the Far East and having them shipped to his warehouse in the US. He then distributed them through clothing companies with stores in malls catering to teenagers.

My bank would open letters of credit on behalf of Jim’s company to finance the imports, and then finance his sales to the stores. Things went pretty well for a time, and then the balance of the customer’s operating account dropped, overdrafts began to occur, and he became late with his loan payments. I also noticed some substantial payments to plumbers and electricians drawn from his operating account.

I dropped in on him at his warehouse in New Jersey, verified that he wasn’t getting any work done on his business premises and asked him about the payments. After several efforts to change the subject he admitted that he was building a house for himself, that there had been some delays and cost overruns, the bank financing the construction wouldn’t let him have any more money, and he had dipped into the company operating account to prevent the trades from taking him to court. I lectured him on the need to keep his company and personal affairs separate. Once I had the full picture, we managed to sort things out and agreed on a plan to get him back to paying his bills on time.

Unfortunately, what Jim did not tell me was that in trying to plug the hole in his cash flow he had jumped on the band wagon when the cargo jeans fad hit. He had a three-week turnaround from placing his order with the manufacturer to receipt of the goods. His first batch of cargo jeans flew off of the shelves! Very pleased with himself, he placed a second order. Receipt of the jeans unfortunately coincided with the end of the craze, and Jim was left with a warehouse full of cargo jeans.

As time went by Jim became more and more desperate, and then a miracle solution presented itself that would alleviate his misfortune. Two gentlemen just happened to drive up in a truck and they told him that someone had informed them that he had some jeans for sale. They agreed to take them off his hands, loaded up the truck and left him with a check. Jim was relieved and was congratulating himself on having disposed of the merchandise at cost. Shortly thereafter the check bounced and Jim realized the only ID he had was a business card with a New York City address, which he quickly found was also fake.

By this stage things were quite serious with the company, and Jim did not even have anything for the police to go on. Jim reached out to me and asked me what he ought to do. I was sure Jim could earn his way out of the hole if he got back to his regular business, and so I got approval to continue working with him, opening one letter of credit at a time. We had to re-do the documentation, so I decided to use a new law firm where I knew an attorney who had some experience with the garment trade. I put my new attorney in touch with Jim’s attorney.

After a few days, without any warning I got a letter from Jim’s attorney threatening to sue the bank for lender liability, accusing the bank of bringing unreasonable pressure to pay and a whole host of other claims I don’t even remember. Feeling somewhat put out given the way in which I had supported Jim at some risk to my own position in the bank, I quickly set up a meeting. When I arrived at Jim’s office, there must have been at least 10 people there, including his regular attorney, a bankruptcy attorney, a couple of accountants and sundry extras. They didn’t want Jim talking directly to me.

The bankruptcy attorney launched into a litany of complaints about the treatment of their client by the bank and then observed that since I had not brought my attorney with me the whole meeting was a waste of time. I couldn’t help agreeing with him and we agreed to terminate proceedings. I parked around the corner, waited for everyone to leave and then went back to have it out with Jim. He was extremely hostile, talked about me leading him up the garden path and suggested that since the relationship was now on an attorney to attorney basis I should leave. I told him that before I left I felt he owed me an explanation. “Well,” he said, “You were the ones who started it when you engaged a firm specializing in bankruptcy.” And that of course was it. No-one had told me that bankruptcy was the specialty for which my new legal firm was best known.

It took us a good while to lower the temperature. The bankruptcy attorney really didn’t want to let go. Eventually I had my new attorney call Jim’s attorney to explain that I wanted my customer to be assured that the bank had no intention of launching bankruptcy proceedings, and eventually things were ironed out. But not before the appearance of a final wrinkle. Assuming that his relationship with my bank was over, Jim had already had his lawyer set up a new company and had opened an account in that company’s name at another bank. He had also called a number of his clients, told them that he had changed the name of the company, and instructed them to wire their payments into the new account.

When I saw the flow of funds into Jim’s operating account at my bank reduce to a trickle, I once again went out to visit his business in New Jersey. Jim admitted what he had done, and promised to transfer the funds. Every month I was sitting on the edge of my seat waiting for the money to come in. Finally, another bank called on Jim and offered him twice as much as we were prepared to lend. He took the loan, paid us off, and that was the end of our relationship.

A central problem of lending to someone like Jim is that you are entirely in his hands. He will do what he thinks is right for his company at any given time. In C&I lending, your customer’s risks are your risks, and the extent to which they decide to take risks and the way in which they manage those risks will determine whether or not you get paid. At this level of lending the principal may not make much distinction between what is theirs and what belongs to the company; when the two become commingled the situation can become complicated. They also may not have that much experience in business. Jim was an excellent designer, but made the elementary error of releasing merchandise against a forged check.

In financial matters, you may well find that your customer is dependent on your designing the structure appropriate to meet their needs, and at the same time may not fully understand or take seriously the terms and conditions you impose. To reduce the risk, you may be tempted to make those terms and conditions very specific, but take care as to how far you go in that direction – for that may be the path to lender liability.

In larger companies, there typically are professionals in place who will help supplement the limited knowhow of the principal. But even then, decisions made by the principal may have far reaching effects for the company. It follows that the more you know about your borrower, the better the position you are in to determine whether you can rely on them to make sensible decisions. During your due diligence, you will therefore be wanting to take a good look at the borrower’s track record (for that reason, lenders are usually reluctant to lend to start up operations.)

One of the first things you are going to ask for is the borrower’s financial statements. In fact, you would think that financial analysis would be the key means of measuring the health and success of a commercial or industrial concern. And so it may be in larger concerns, but with small businesses it may not be so simple. The quality of your analysis is only as good as the financial data on which it relies.

When you receive financial statements from a small business, they most likely will be the result of a collaboration between the principal and his accountant. You may well have no cash flow statement, just a profit and loss and a balance sheet, and you will probably have no explanatory notes. That’s what I used to get from Jim, and I could never be sure of whether they were a true reflection of the company’s financial status. If the borrower is a bit larger, then you may be able to require submission of accountant-prepared compiled statements. These will at least be presented in accordance with accounting standards, but that’s pretty much where it ends.

The accountant is still entirely dependent on the information supplied by the borrower. There may, for example, be numbers representing inventory, but the accountant will not have verified that those numbers are correct. Again, there may be balances representing amounts receivable from the borrower’s customers, but there will be no indication as to whether they are collectable. If the accountant is aware of any misstatement or omission he must of course include that fact in the statement, but that is as far as it goes.

You can go a step up to reviewed statements; these will cost your client more money. The accounts should be prepared with more objectivity, since the accountant is required to be an unrelated party, and is obliged in the process to develop a thorough understanding of the company, its operations, its industry, and its accounting policies and practices. But he still doesn’t give you any more than a statement that he is not aware of any modifications that need to be made to the statements for them to be in conformity with generally accepted accounting principles.

To obtain full comfort that the numbers being presented to you can be relied upon, you need a full audit with the corresponding auditor’s opinion. Such audits are quite expensive and beyond the means of most small businesses.

Whatever level of comfort you do obtain, you will be well advised to make contact with the customer’s accountant. With a few judicious questions you should be able to determine how good the accountant is and how well he knows his client’s business.

An additional word on financial analysis – the riskier the business, naturally the more comprehensive you will want your analysis to be. Yet on the other hand, with the size of loan we are talking about, the profitability of individual relationships is going to be limited, so overheads need to be kept within bounds. It is worth bearing in mind that if the financial data are not totally reliable, comprehensive analysis is also going to be limited in its usefulness. For example, a current liquidity ratio calculation is not going to help you if a significant portion of stated inventory turns out to be obsolescent. Credit analysis is useful but in small business lending, my initial focus will still be on the competence of management.

There is another aspect of Jim’s business which is worth commenting on. He was heavily dependent on fashion. He got badly burned on the cargo jeans. His whole business depended on his ability to read fashion trends and react quickly. As I mentioned above, I inherited the account, and because of his business I do not believe that I would have entertained him as a new customer. Small business lending is complicated enough in the first place without adding an extra layer of risk. Some other activities I found in my portfolio that posed additional risk:

Restaurants and catering – this is an area which is highly cyclical. During economic downturns when discretionary income becomes scarce, restaurants are often the first to suffer. Restaurants, especially individually owned small restaurants, rarely have a strong capital base so there is little to cushion them against the hard times. Restaurants may also be subject to trends in fashion. If ownership can’t keep up it may be difficult to stay in business.

Construction – this again is highly cyclical. As the recession hits the demand for new housing plummets. The typical small house builder is left bidding for modification work. Most of his capital will have been tied up in his most recent project and if it is a spec house and he has to reduce his price he may not be in a position to continue in business. He may on the other hand be working on a specific contract and exposed to all the risks that that involves (see Contract work below).

High Tech – the technical world moves quickly, and any business involved in the production and/or distribution of high-products may be at continual risk from obsolescence. This can happen to large companies too, as Kodak learned to their cost. In the personal computing world, focus has shifted from desktops to laptops to iPads to smart phones in the space of a few short years. A similar story with videos, and now a major change as Amazon revolutionizes the retail trade. Almost any company these days can be impacted by novel hardware and/ or software solutions, companies directly involved in high-tech products even more so.

Perishables – lenders have long been risk averse where companies dealing with food are concerned. Because of this aversion, most farm crop lending is done under government programs. Where companies handle food, there is the ever present risk of spoilage because of either delays in bringing products to market or inability to control conditions under which products are being stored or moved.

Seasonal businesses – any company that depends on selling the bulk of their goods or services during one or more specific periods during the year presents additional risk. For example, bad weather occurring during key Christmas shopping days can be disastrous to toy stores.

Contract work – lenders prefer to see a steady and predictable flow of revenue. Contract work brings with it a number of uncertainties, including whether the company can organize its bids to achieve that steady flow, how good the company is at calculating costs and ensuring the outcome is profitable, whether the contract can be completed on time and whether the company can achieve the required level of quality of work. In my portfolio, I had a software developer. His principal customer kept changing the specifications. Eventually he gave up the project and had to sue for payment.

This is not an exhaustive list but it is enough to show that certain specific activities can involve significant additional risk. If you are going to lend in these areas, don’t go with a potential borrower that you are not sure of.

Small business lending will not always be the roller-coaster I described above, although the previously described scenario is not uncommon. According to Gallup, 50% of businesses fail within 5 years of startup. Other research suggests that management incompetence is to blame for failure in 70% of the cases. I held onto my small business portfolio for three years and then moved on to another area. I think we did better with our customers than these statistics suggest. But I would still say that you must be very selective with who you go with, that you should look at financial statements with skepticism, and that you should be ready for just about anything.

Christopher “Kit” Webbe Executive Consultant, CEIS Review